In Consumer Crypto, Greed is Good

It has been said that successful consumer products map to one of the seven deadly sins. Tinder, Instagram, and Netflix represent Lust, Vanity, and Sloth, respectively.

Consumer crypto is no different—our products must compete for dominance within a sin in order to gain adoption with mainstream users. New products win through high differentiation that makes them 10x better than incumbents.

So we must ask ourselves, does adding crypto to a product make it better at Gluttony than Uber Eats, better at Wrath than Twitter, better at Pride than Linkedin? — I think not.

The only sin that crypto helps with is Greed. Crypto apps sell the idea that using them will make you richer. This puts them in competition with other apps that sell the same idea, such as Robinhood, Draft Kings, and Coinbase.

Let's look at some of the most successful consumer crypto apps. Crypto: The Game is my favorite. It’s a cutthroat game with a giant pile of cash at the end (I love it). Similary, Polymarket is making waves by letting us bet on real-world events. In both of these, the winners take the money of the losers.

Crypto makes these products better than their legacy alternatives, so they can engage a wider audience. On the flip side, when an app is not able to break out of crypto native users, an insider group of attention-deficit gamblers (and swarms of bots) wring it dry and drop it like a hot potato for the next new thing.

Friend.tech did $90m in volume and were hailed as the future of social media—but they just shut down. Why? Because they found PMF in Greed, and their v2 didn't introduce a new game to play for money. The update focused on broader adoption, but it didn't threaten incumbent apps in any of the deadly sins.

Farcaster gained adoption within crypto because users were printing money from $DEGEN tips, but the founders say it doesn’t have differentiation for mainstream users yet.

So, if you're building in consumer crypto and you have aspirations to take your product mainstream, I hope you like casinos, because you’re building one.

Onchain Culture and the New Renaissance

We love to say someone got “crypto-pilled” and “fell down the rabbithole”. This isn’t just slang—it’s a fundamental shift in worldview. Ask about the moment crypto “clicked” for someone and you’ll often get an unexpectedly personal story, even rivaling a spiritual experience.

I can recall two moments that shaped my own journey. The first, when I understood that not all nations can trust their government to maintain the value of their currency, making Bitcoin a compelling store-of-value. The second, when I used my first dapp on Ethereum and saw my OpenSea profile hydrate with assets from a game made by a different company. These moments transformed how I saw the world by breaking down the impermeable borders between countries and apps, respectively.

There was no going back. My brain just worked differently after that.

It's no surprise that we’re embracing crypto after what we’ve witnessed. Martin Luther sparked the Protestant Revolution when he nailed his criticism to the doors of the church. Similarly, Satoshi kicked over the first domino for us. He/she published the Bitcoin Whitepaper in the wake of the ‘08 crash—the fallout of our own corrupt institutions selling indulgences in the form of credit ratings.

The Protestant Revolution and the Renaissance were characterized by a whole new way of viewing the world and humanity's place within it. After fifteen years of germination, we're finally reaching the point where onchain culture can have a similar impact.

When I say "onchain culture", I'm referring to those of us who have made our way down the rabbithole. We are rethinking our relationship to money, art, ownership, and intellectual property. We now have the tools to steward this worldview into our art, products, and technology.

If you’re reading this, you have a chance to put a dent in the universe. Pay attention to what’s emerging within you. Clear your channel. Create something only you can, just because you want it to exist

Welcome to the New Renaissance.

Onchain Social ≠ Onchain Social

When I say "onchain social", I mean "onchain" in the loosest sense. To me, onchain means sufficiently decentralized and therefore available across contexts. This will drive some of you mad, but you'll just have to get over it in the name of broader adoption. Just as people don't think about the "line" in "online", they won't think about the "chain" in "onchain". It will just mean "available across apps/websites" the same way that "online" means "available across devices".

To the chagrin of many in this space, technical correctness is not the highest good in the realm of memetics. That's why we use email, online, and onchain instead of e-mail, on-line, and on-chain. The latter are technically correct, but the former are better memes. The best meme wins because it is easier to spread and understand—not because it is more correct.

That's right, progress will be made at the level of memes. If you doubt that, say "NFT" around the average 20-something and watch their eyes hit the back of their skull faster than their last pickleback shot. Losing that term set us back years in adoption, and a lot of it was due to many of you using words like "provenance", "interoperable", and "smart contract" on a first date.

One day, you'll get to be the parent who says "you know chain stands for blockchain" just as our parents remind us that they couldn't check AOL and use the landline at the same time. Consider it your Purple Heart for being on the battlefield in these early days. Endure these small losses to win the larger war, I beg you.

So when I say "onchain social", I mean online social where my profile, social graph, interests, and media are available across apps. Where I don't need to restart my whole damn identity every time I try a new app. Where I show up to a new party, and all the same friends are there. Same people, different context, new experience.

I don't care if the data is on a blockchain, on Farcaster, or both. When I show up to your app, be a good host: know my name, point me towards my friends, and show me something you know I'll love.

And for the love of God, do not say a damn thing about NFTs.

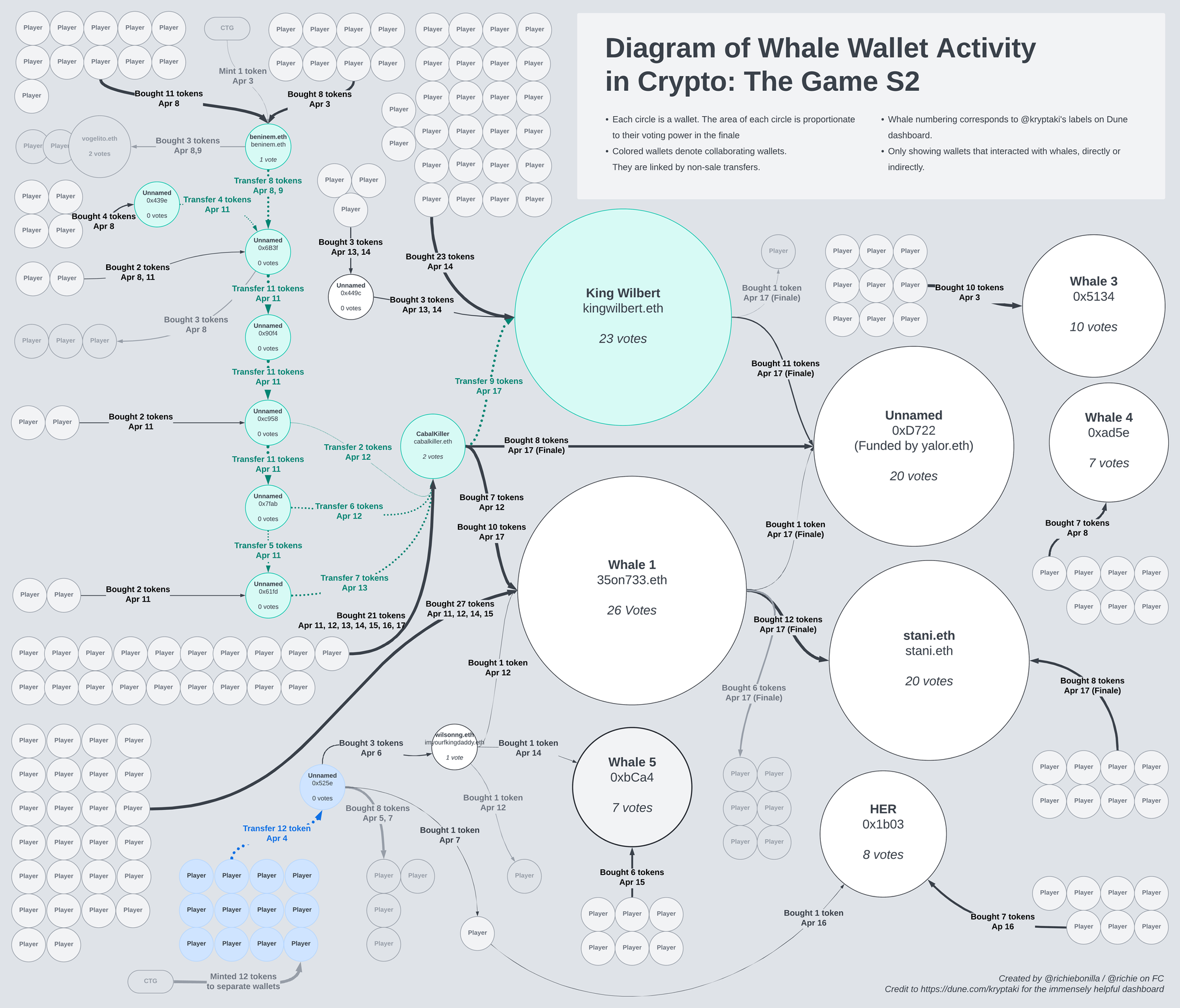

CTG S2 Finale: Where did the whales go?

The untold onchain story of the Crypto: The Game S2 finale

The finale of Crypto: The Game Season 2, an internet-native reality game, showcased the complex dynamics between players, whales, and the broader crypto community. As the season drew to a close, the game's unique structure, which allowed players to buy, sell, and transfer their NFT-based slots, created a captivating "metagame" that extended beyond the challenges and eliminations within the game itself.

This essay explores the tension between "shrimp" and "whales," the collective strategizing among players to rally behind a unifying cause, and the unexpected twists that led to a memorable conclusion—one that not only crowned a winner but also highlighted the crypto community's solidarity in the face of real-world challenges. What started as a reality-TV-style game, became a mirror that taught us a bit more about who we are as an industry.

According to Dylan Abruscato, the game's host, each season is "a case study on human behavior" [1]. In keeping with that intention, my goal in writing this piece is to provide an overview of what we know based on the onchain record. I believe this adds additional layers of understanding to the case study and provides us with some questions worth pondering.

If there are other primary sources I have missed that shed further light on this, please feel free to reach out.

What is CTG S2?

Crypto: The Game is an internet-native reality show in which hundreds of players buy-in for 0.1 ETH and compete for a chance to win the entire pot. The game operates in 10-day seasons, and players compete in challenges each day to win immunity from the elimination vote held each evening. Players eliminated throughout the season are added to the jury and vote to decide the winner on the final day.

Each season features a unique theme and twist. The theme of Season 2 was "Anon Island," and players were able to choose whether they would connect their Twitter account or play anonymously. Unlike Season 1, each player's slot in the game was represented by an NFT that could be transferred, bought, or sold at any point. Season 2 attracted 800 players who competed for a pot of 72 ETH (80 ETH less the 10% that goes to the game's creators).

CTG S2 was an "open economy" game

Savvy game designers will recognize that putting voting power onchain turns CTG S2 into an "open economy". In other words, the game economy becomes intertwined and, therefore, influenced by the broader economic landscape outside the game. The ability to buy and sell Jury NFTs—and therefore voting power—incentivizes actors outside the game to get involved to win the $250,000 pot. While the game itself is comprised of puzzles, challenges, and elimination votes, the game of accumulating and directing voting power can be described as the "metagame" or "the game outside the game".

This is a well-understood concept amongst professional game designers, partly because it has caused some of the game industry's most spectacular failures. While major game studios haven't used much blockchain in their titles, some games allow players to purchase in-game assets with credit cards and trade them between player accounts. A famous example is the "Real Money Auction House" in Diablo 3, which was such an issue that Blizzard removed the auction house entirely and launched an overhaul of the game's loot system to fix the in-game economy.

Fortunately, CTG S2 was no such failure!

I first became familiar with this concept in 2019 when I worked with a team of professional game designers, creating a Final Fantasy-style RPG with onchain assets. While they were enamored with the possibilities of interoperable, transferrable, and resellable assets, they were well aware that this could also destroy the game itself by turning it into a pay-to-win experience.

However, it's important to note that open economy games aren't inherently pay-to-win. It depends on which game assets are purchasable and how they relate to a player's chance of winning. For example, in Fortnite, players can purchase skins to change their character's appearance, but these upgrades are solely aesthetic and do not enhance a player's performance. In contrast, the purchasable assets in CTG S2 were votes in the finale, directly correlated with a player's likelihood of winning the pot—setting the stage for a dynamic and controversial finale vote.

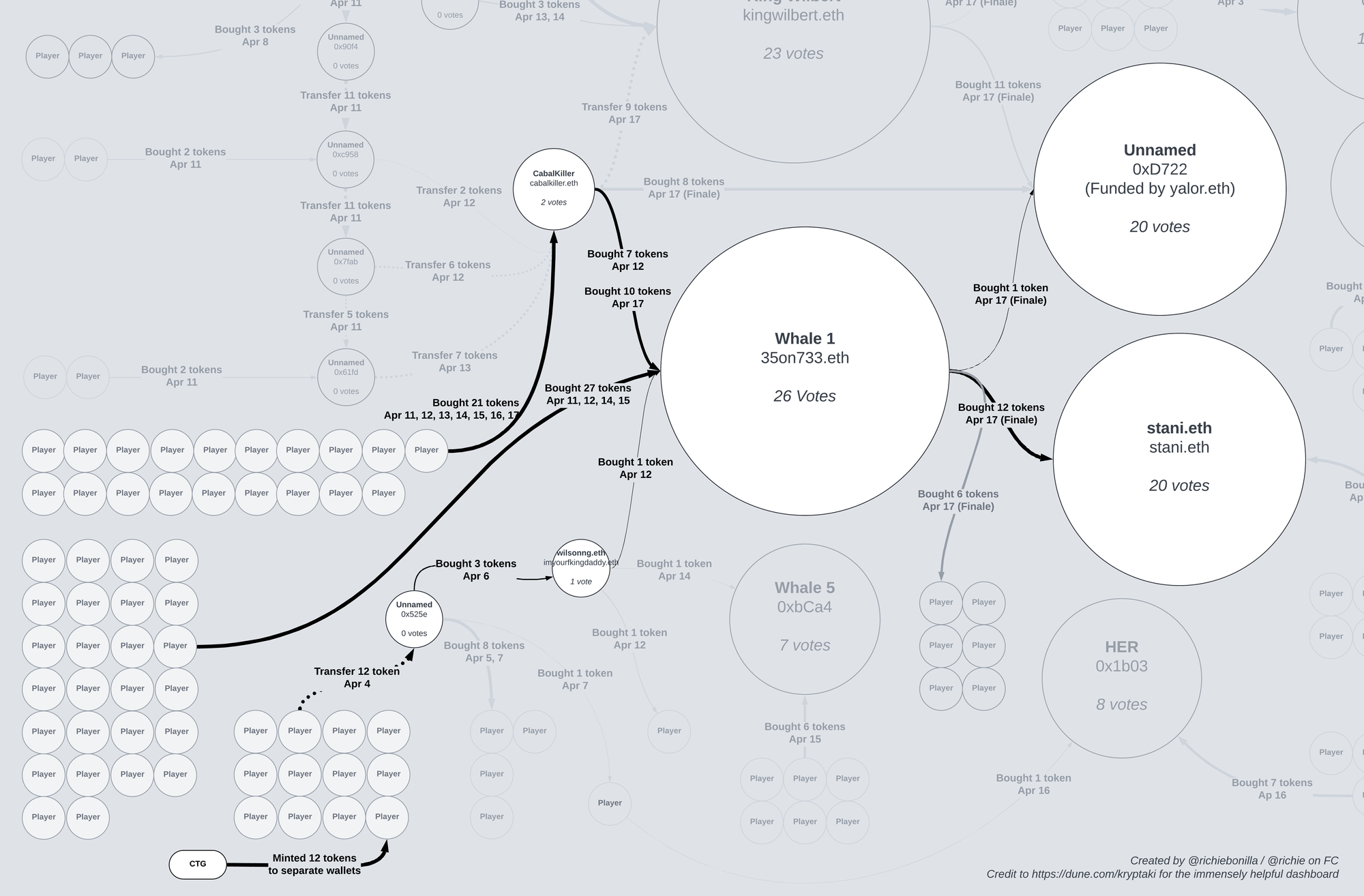

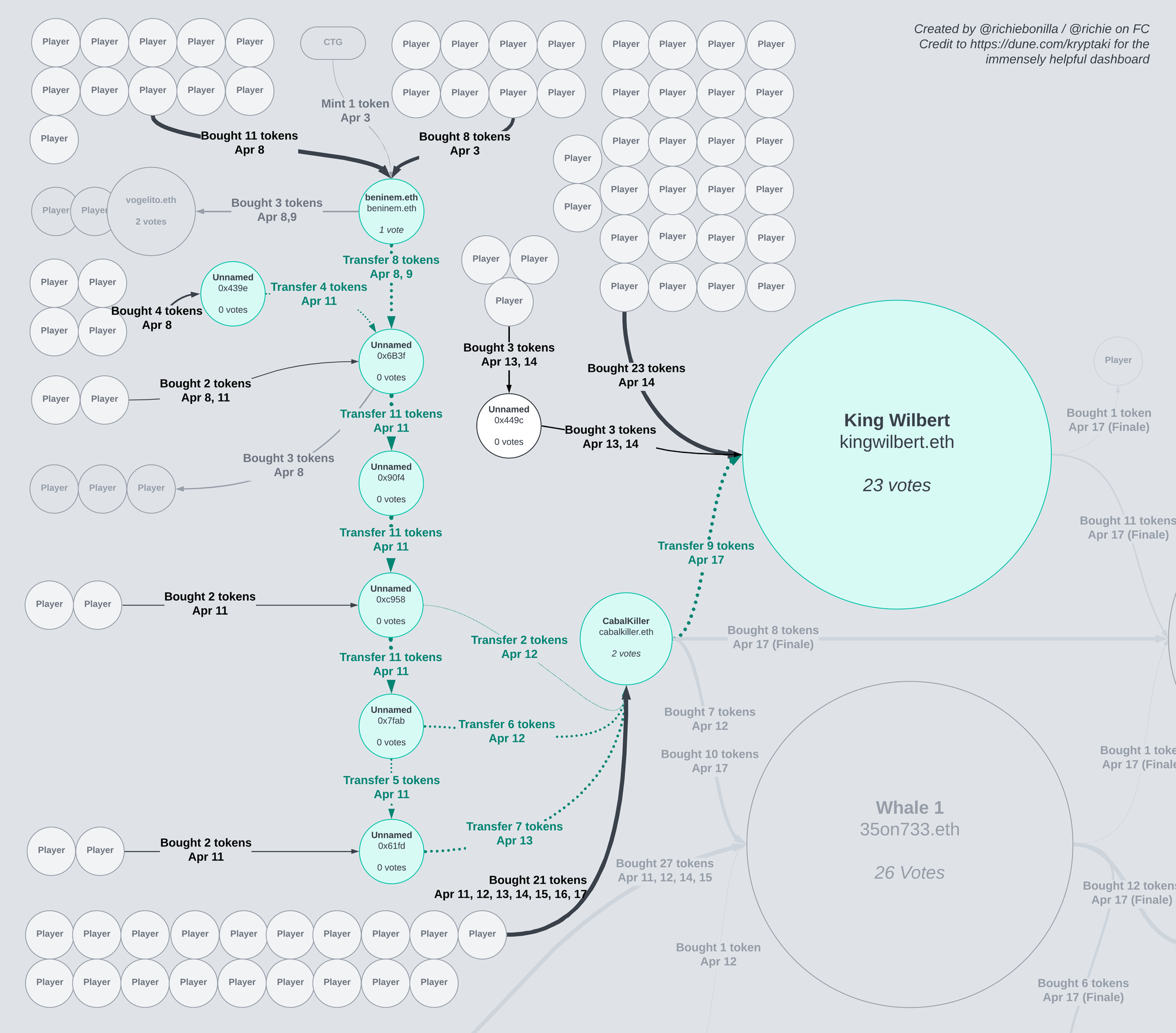

Shrimps vs Whales

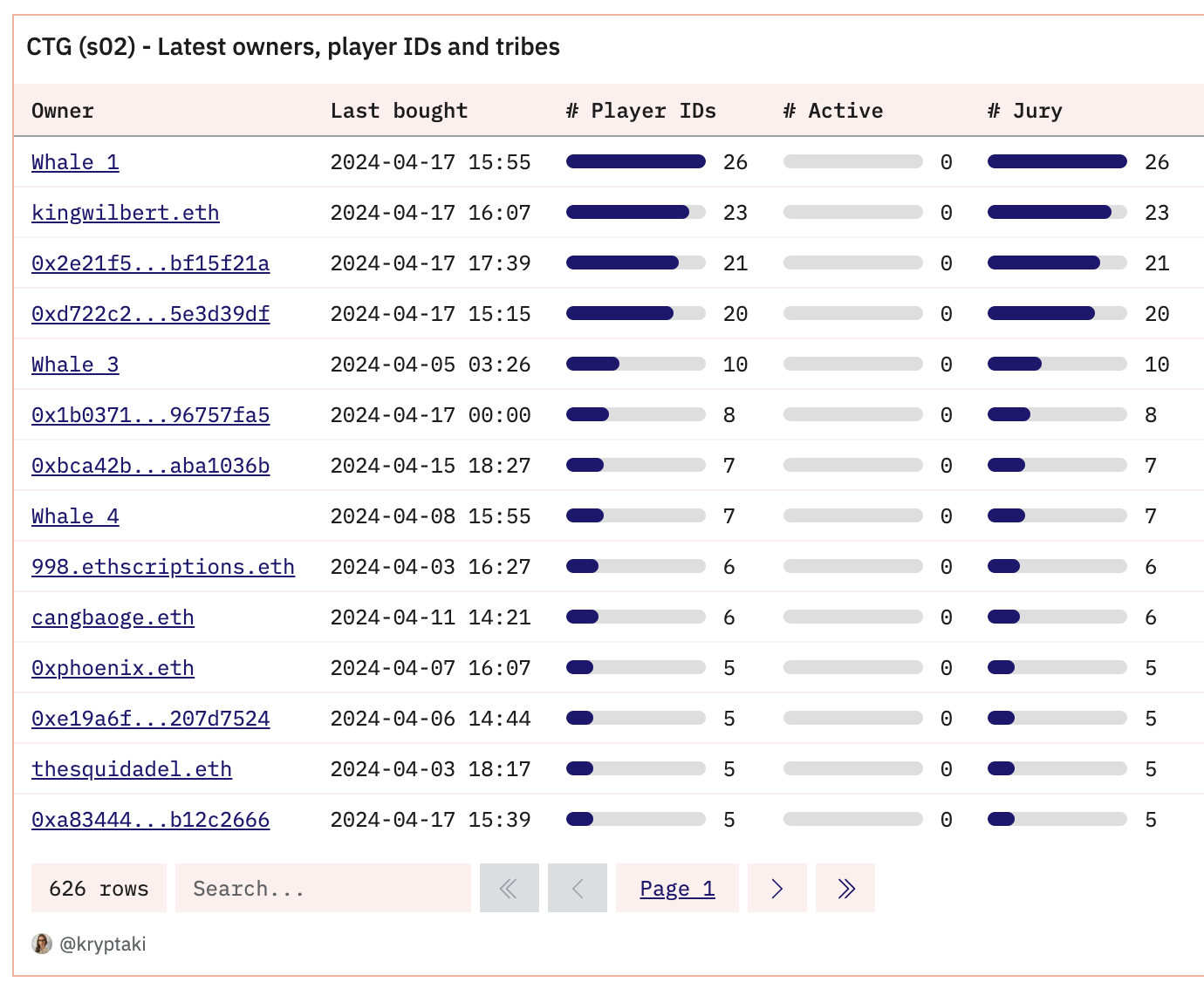

This tension was not lost on the game's players. As we became aware of a few wallets accumulating jury votes, the dynamic in the game shifted from "humans vs anons" to "shrimp vs whales." The incredible Dune dashboard by @kryptaki allowed everyone to see the looming threat of whales deciding the final vote, like a storm cloud rolling in over the mountains [2].

Going into the Apr 17 finale, the whales had accumulated 130 votes across seven wallets [3]. If any of these actors were working together (or were the same person), they would have a high chance of choosing the winner.

Players realized that their best chance to avoid whales capturing the pot was to avoid splitting their votes across too many candidates. There was a collective cry to rally around a single candidate to deny the whales their winnings.

It’s worth noting that a sophisticated whale who spread their tokens up across dozens of wallets would not show up on this dashboard because they would avoid accumulating too many tokens in any single wallet. The looming threat of a “shadow whale” of this nature kept the heat up even as players could see whales selling their tokens on finale day.

Collectively Strategizing the Best Endgame

There were several active Telegram chats on finale day, each with their own ideas for how to unify the vote behind a single candidate:

- Put a finalist NFT in a DAO that would split the winnings equally amongst all jury members who support it.

- Delegate voting power to a single finalist who would take half the pot and split the other half amongst the jury members who support them.

- Rally behind a single player who had the best story or played the best game because that was best for CTG itself.

Some ideas involved splitting the pot with the idea that they might bait whales into supporting them by sharing the winnings.

Players lamented in group chats and DMs that there wasn't a candidate with a "good enough story" to rally the jury behind.

While I had no idea what would work in the end, I felt confident at the time that splitting the pot was the most boring outcome, and it wouldn't win. Players from Season 1 will remember the Splitter vs. Anti-splitter debate—I fall firmly on the latter side of that one.

A Unifying Story Emerged

While each of these groups had some traction, none seemed like they had the enthusiasm to rally a supermajority of jury members. However, there was one plan that sucked the air out of the rest, and this was the story that took home the pot.

On the morning of Apr 17, I got pulled into a Telegram chat titled "realest people" led by Eva Beylin and David Phelps. They spelled out a plan to steal the constitution donate the Season 2 winnings to the legal fund representing Alexey Pertsev and Roman Storm—two developers who were arrested and are facing prison sentences for contributing code to the Tornado Cash project. Eva and David argued that while we were enjoying our freedom playing a game with the theme "Anon Island," the creators of anonymity-preserving technology were behind bars. This was our chance to support them and turn it into a collective win for the entire crypto space.

To the surprise of the proposal's instigators, it was not unanimously popular amongst the jury base. Some jury members grumbled that donating the money was not in the spirit of a game with the slogan "Many will play. One will win." Others questioned the likelihood of success, preferring that passionate supporters of the plan donate to the legal fund directly instead of spending ETH buying Jury NFTs only to risk losing to the whales anyway.

Regardless of where on the spectrum of enthusiasm they fell, many jury members acknowledged that the plan was the best chance at a unifying narrative that would mitigate the risk of splitting the vote.

For fans of CTG, therein lies an important nuance that is unique to this season: The story of supporting the Tornado Legal Fund wasn't just a feel-good outcome, it was proposed against the backdrop of a handful of face-less anonymous whales who had accumulated very real voting power—threatening to take the pot for themselves…or were they?

Executing the Plan

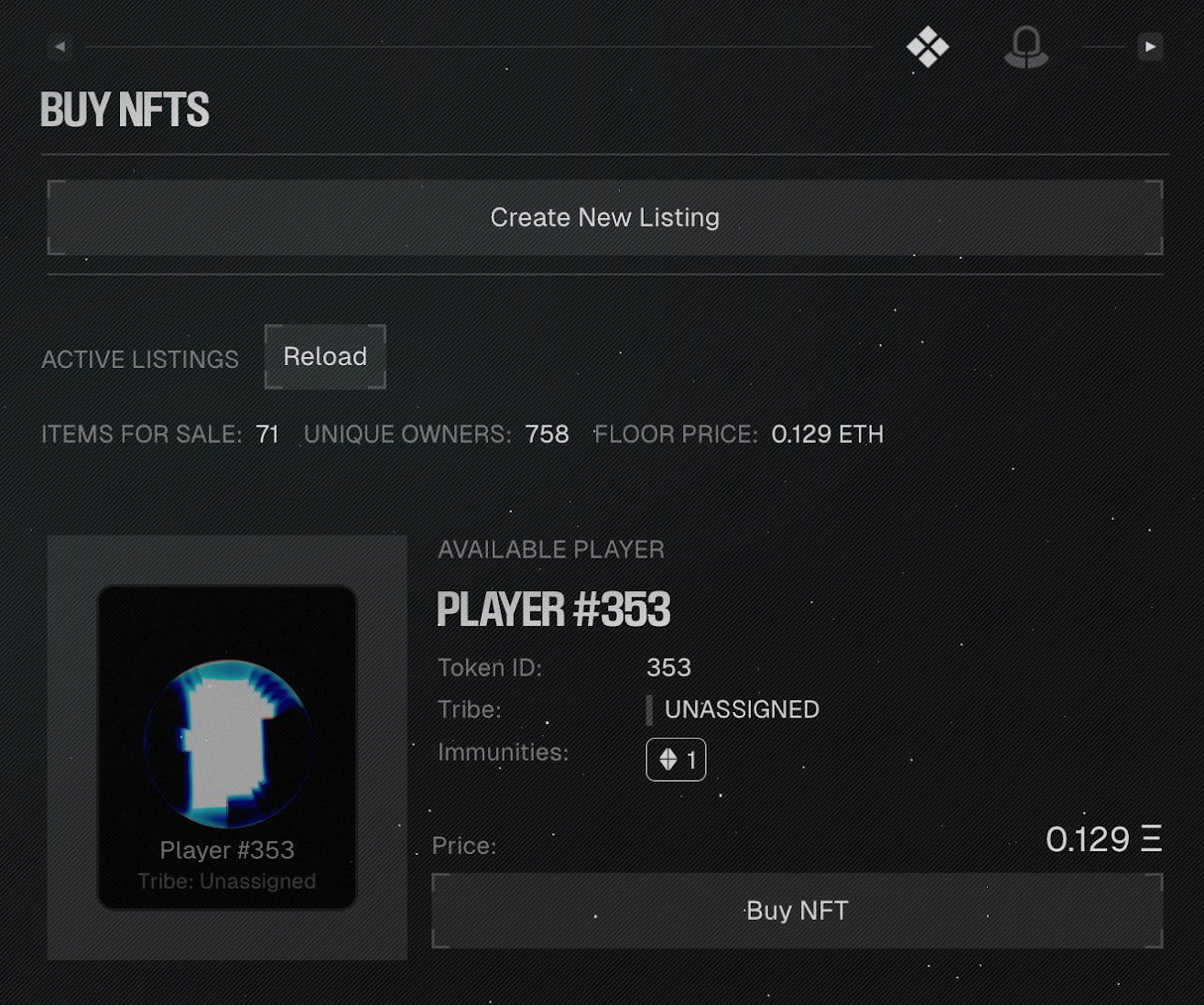

With a few dozen people in the chat, the "realest people" got to work. They set up a multisig with 5 signers, found a CTG finalist willing to donate their active Player NFT, and members began buying votes [4]. The donated NFT was Player #733, a token held by a single wallet the entire game.

Stani.eth and [a wallet funded by] Yalor.eth swept up 20 votes each. Shortly after this, "Whale 1" registered the ENS name "35on733.eth," which I feel comfortable interpreting as a declaration of support for the cause [5].

This means that within the first hour of the finale, Player #733 already had at least 66 votes behind them, which is more than the 54 votes the second-place finisher (Ted) received in total.

The final vote tally turned out as follows:

- Player #733: 171 votes - Coordinated by Eva Beylin and David Phelps

- Ted: 54 votes

- 0xJeff: 32 votes

- Will: 16 votes

- Mathijs: 16 votes

- Devin: 14 votes

Since votes in CTG are offchain and private, we cannot attribute the remaining 105 votes that Player #733 received, but it felt to me that they had a groundswell of support from the jury based on messages sent in Telegram and posts on Twitter.

So, where did the whales go?

When it became apparent that whales were accumulating jury tokens, the dominant narrative was that they were angling to steal the pot for themselves. The beauty of an onchain record is that we get to examine their actions and see how they might challenge the personas we collectively projected onto them.

Were these whales as selfish as everyone feared? Let's take a look:

The biggest whale flipped in support of Player #733 (winner)

As mentioned earlier, "Whale 1" registered the ENS name “35on733.eth” 40 minutes into the final vote, indicating that they had decided to support the Player #733 initiative [6]. They held 26 votes in the finale and were buying tokens up until five minutes before voting opened.

On finale day, two wallets that had not previously interacted with CTG swept up 20 votes each. This made them the third-largest and fourth-largest jury voters. These new wallets, Stani.eth and Yalor.eth, also supported Player #733.

We don't know if Whale 1 was a member of the "realest people" or if they were just sympathetic to the cause behind Player #733's campaign.

I haven't seen evidence of whales supporting Ted (second place)

Despite the claims that Ted was backed by “the cabal”, and while it may be true that some of the smaller whales cast their votes for Ted, I have not seen evidence of it at the time of writing. That said, I would happily amend this post in light of new evidence.

Two of the biggest whales supported 0xJeff (third place)

It appears that CabalKiller and King Wilbert were the same person (or were at least colluding). These two whales accumulated tokens separately until the final day, when CabalKiller transferred 9 tokens to King Wilbert without a sale.

There was also similar messaging spouted on social media by King Wilbert and a user whose wallet was funneling Jury NFTs to CabalKiller. The King Wilbert account on Twitter was pretty consistent in their anti-influencer messaging, even going so far as to order the elimination of employees of the companies that sponsored (Uniswap, Lens) or supplied technology to (Privy, Coinbase, Boys Club) the game itself. All of these affiliated groups counted as "cabals" in their book—even though many of the claims they made were unfounded.

This conspiratorial messaging was mirrored by Beninem.eth on Twitter, who expressed support for 0xJeff, and described Player #154—the token held by Ted—as "an influenza who was sneaky to get into the finals." This is significant because Beninem.eth is the name on the wallet that funneled jury tokens to CabalKiller, providing us with another concrete link between CabalKiller and King Wilbert.

King Wilbert also declared support for 0xJeff on Twitter (23 votes). I, therefore, feel safe assuming that CabalKiller's remaining 2 votes were cast the same way.

This leads me to believe that 0xJeff received 26 of their 32 votes from this one actor, explaining how they shot up the charts into third place late in the finale. I don't have reason to believe that 0xJeff was working with this whale; they were just chosen as the "underdog" candidate due to their low public profile.

This begs the question, why did CabalKiller sell 25 votes (and buy 2) in the hour before voting started? These votes were bought by 35on733.eth and Yalor.eth, who cast them for Player #733. They could have used those votes to single-handedly send 0xJeff home with a silver medal—and they may have even inspired others to support him.

It's deeply ironic that after all this "anti-cabal" messaging, CabalKiller sold its voting power to the candidate backed by Stani.eth, the CEO of Lens Protocol, one of the game's sponsors.

How did the four smaller whales vote?

These wallets held 32 votes, but I couldn't find any public declarations of support for a candidate or evidence of whether they voted at all. These wallets behaved similarly; each buying 7–10 tokens in a single sweep and then remaining inactive from that point forward [7].

Food for thought

Were the whales as selfishly motivated as we imagined?

CabalKiller and King Wilbert seemed to be motivated by an anti-influencer, anti-sponsor vendetta. Despite their unsubstantiated claims of cheating and conspiracy, King Wilbert's motivations seem more "in the spirit of the game" than not—preferring that the pot goes to a low-profile candidate, similar to what happened in Season 1 when M.F.L. took home the prize.

Whale 1 flipped to supporting Player #733 in the final vote. Would someone motivated exclusively by personal greed so readily support a charitable cause?

The other whales didn't make waves, and it's possible they didn't vote at all. As a result, it's hard to speculate on their motivations.

Did whales buy the win for Player #733?

Player #733 received 66 votes from just three wallets, while Ted (the second-place finisher) received only 54 votes total. Therefore, it's tempting to claim that these whale voters decided the winner independently. However, I think this oversimplifies the voting dynamic. If the other 105 votes had not been cast for Player #733, they could have radically changed the outcome.

At the same time, it would be unfair to claim that Player #733 would have won as definitively without those 66 votes. This is due to the way that CTG voting works....

When a vote is live, people who have not voted can see the current standings. When voting opened, Player #733 shot to the top right away. This prompted many voters to wonder who this was and seek out their backstory on Telegram and Twitter. I don't think we can ignore the effect this likely had on recruiting more jury members to the cause.

It turns out that a number of the tokens accumulated by stani.eth and yalor.eth were already used to cast a vote—these are likely the ones they bought from by 35on733.eth after voting had already started—so their actual impact was likely less than it seemed.

Closing Thoughts

As we reflect on this season, we are invited to ponder the impact that decentralized technologies have on what we build and the games that we play together—not only the games we design but also the metagames that emerge in, around, and between them.

CTG S2's open economy held a mirror to our space. In that mirror we feared seeing greedy boogeymen gobbling up votes to steal the prize money for themselves, but what we found were a whole lot of people interested in turning an individual win into a collective one.

This is powerful not just because it feels good but also because it aligns with our claims about crypto's impact on the world.

* * *

Thank you to Cynthia Vlad, Bhaumik Patel, David Phelps, Diana Chen, Zakk Fleischmann and Dan Hunt for reviewing drafts of this.

And thank you to Dylan Abruscato, Tyler J. Cagle, and Bryan Lee for creating CTG. It is, without a doubt, the most fun I’ve ever had online.

Notes

[1] Dylan said this most recently on the Season 2 Recap episode of Boys Club at 10m 30s https://open.spotify.com/episode/1Sa6q1mAvbu9pG3ym77GoM?si=ca83ca1771184a7f

[2] Not only was this dashboard a valuable reference for players during the game, it was an immense help to the onchain research I did when researching this piece and creating the Whale Activity diagram above. View it here: https://dune.com/kryptaki/ctgs02-holdings

[3] In this context, "whales" are with 7+ votes going into the finale. On the morning of Apr 17, the 130 whale votes were split across seven wallets as follows: 45 (35on733.eth), 28 (Cabalkiller.eth), 25 (Kingwilbert.eth), 10 (0x5134), 8 (0x1b03), 7 (0xad5e), and 7 (0xbca4).

[4] Multisig holding Player #733 on Base: https://basescan.org/address/0x0adf1a21eb41b0d24bc51c1c36d8cc1bdd724075

[5] From now on, for simplicity, I'll refer to "the wallet funded by Yalor.eth" as “Yalor.eth”.

[6] These labels follow the ones used in @kryptaki's Dune dashboard.

- "Whale 3" - 0x5134B2E0F304B77F38b64dC52CF84234fAD72925

- "Whale 4" - 0xad5e99ba37fa775d7129954acfc2d2ecfca6fed9

- "Whale 5" - 0xbCa42B62cBbdb2D13BDA850e87e94a77aba1036B

- "0x1b03" - 0x1b037167C4b0584Ca5Ef6534648C38F496757FA5

[7] Here's a quick look at these wallets:

- Whale 3 was funded by a person who did not declare support for a candidate on social media. They bought 10 votes on April 3–4 and held them through the finale.

- Whale 4's wallet has been dormant since 2018 until it bought 7 CTG tokens on Apr 8, which it held through the finale.

- Whale 5's wallet was created on Apr 14 and its only activity is buying CTG tokens. They bought 7 votes on Apr 14–15, which they held through the finale.

- 0x1b03 was active 2017–2021 and has since been dormant until it bought 8 CTG tokens on April 16, which it held through the finale. Fun fact: This wallet is an original minter of CryptoKitties back in 2018—which is OG status in my book.

- If you control one of these wallets and would like to anonymously declare who you supported, please contact me, and I will amend the above while preserving your anonymity.